Long-Term Mortgage Rates Decline: What It Means for the DMV Real Estate Market

Long-Term Mortgage Rates Decline: What It Means for the DMV Real Estate Market

In recent weeks, the financial landscape has shown a promising trend as long-term mortgage rates have decreased for four consecutive weeks. This decline can have significant implications for the real estate market, particularly in the DMV (District of Columbia, Maryland, and Virginia) area. By exploring the factors behind this trend and its potential impacts, both current and prospective homeowners can make more informed decisions.

Understanding Mortgage Rates

Mortgage rates are influenced by various economic factors, including inflation, employment rates, and the overall health of the economy. When rates decline, borrowing becomes more affordable, which can incentivize home buying and refinancing. For potential buyers in the DMV area, lower mortgage rates may represent a valuable opportunity to enter the market.

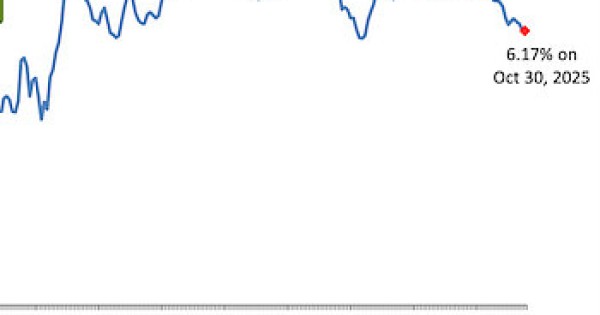

The Recent Drop in Mortgage Rates

Over the past month, long-term mortgage rates have shown a consistent downward trajectory. This may be attributed to various economic indicators, such as improved investor sentiment or adjustments by the Federal Reserve. As rates fall, many buyers have started taking notice, prompting a surge in mortgage applications as individuals seek to lock in favorable terms before any future increases.

The Impact on Homebuyers in the DMV Area

For homebuyers in the DMV region, lower mortgage rates can lead to more affordable monthly payments. This is particularly relevant in a market known for its competitive prices. With the median home prices in the DMV area often above the national average, even a small reduction in mortgage rates can translate to significant savings over the life of a loan.

Refinancing Opportunities

Additionally, existing homeowners may also take advantage of the declining rates by refinancing their current mortgages. Refinancing can lead to lower monthly payments or a reduced loan term, resulting in substantial savings. Homeowners are encouraged to assess their current mortgage situation and consider consulting with a mortgage advisor to explore their options.

Market Predictions and Future Trends

While the current trend of decreasing rates is promising, many factors could influence future rate fluctuations. Analysts predict that rates may continue to hover at lower levels for the near term, but various economic developments, including inflationary pressures and employment figures, could alter this trajectory. Keeping an eye on these indicators can help buyers and sellers plan their next steps in a constantly changing market.

The Role of the DMV Real Estate Market

The DMV real estate market is unique, characterized by a blend of urban and suburban options. The presence of government institutions, universities, and tech companies contributes to a dynamic housing market. With lower mortgage rates, we may see increased competition and demand for homes, particularly in sought-after neighborhoods. This heightened demand could lead to quicker sales and potentially increase prices in the short term.

Conclusion: Long-term mortgage rates declining for four consecutive weeks presents a significant opportunity for both homebuyers and current homeowners in the DMV market. As the landscape continues to evolve, staying informed about rates, market dynamics, and economic indicators will be crucial for making sound real estate decisions. Whether you're looking to buy a new home or refinance an existing mortgage, now may be the opportune time to explore your options.